38+ How much will mortgage lenders lend me

The low end hovers around 35000. Based on this calculation the lender.

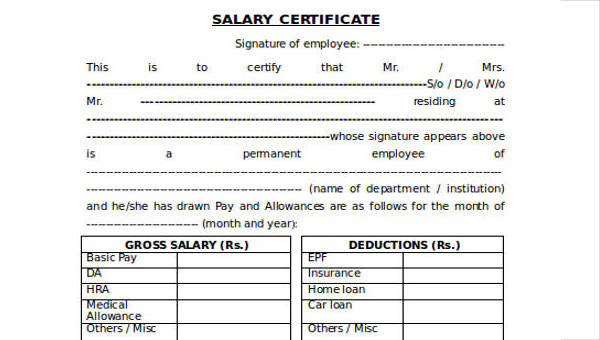

Free 38 Sample Receipt Forms In Pdf

Mortgage lenders generally make good money.

. Fill in the entry fields. Often lower percentages are loaned on properties outside urban areas and on apartments. You can plug these numbers plus.

Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. The first step in buying a house is determining your budget. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house loan for the purpose of purchasing.

Generally we can expect a lender to lend up to 80 of the value or price of a house. So the debt-to-income ratio is a decent. This mortgage calculator will show how much you can afford.

Calculate what you can afford and more. Your servicer will then use that money later when those bills come due. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. Assuming principal and interest only the monthly payment on a 100000 loan with an of 3 would come. To calculate your DTI ratio you would simply add up all of your monthly debt payments and divide them by your gross monthly income.

To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards. This allows for a healthy cushion for the lender while still providing enough funding. As an example For a 475K property loan at 95 LVR inclusive of LMI the LMI could be around 15k.

Under this particular formula a person that is earning. A 95 loan at 660k could result in LMI of about 30k. News extensive mortgage lender directory with up to date interest rates top lenders pick and home buyer resources for every state.

Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. Ad 2022s Best Mortgage Lenders. LMI is always capitalised into a.

So for example if you had an annual salary of 200000. Medium Credit the lesser of. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

However most hard money lenders will loan between 50-70 of the value of the property. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Though some are on a flat salary most make the bulk of their income on commissions.

The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

Free 38 Certificate Forms In Ms Word

Just Hit 100k My First Milestone R Stocks

38 Sample Closing Statement Templates In Pdf Ms Word

Business Partnership Proposal Letter How To Create A Business Partnership Proposal Letter Downloa Proposal Letter Business Proposal Letter Business Proposal

Financier Mortgage Group License 236854 Home Facebook Loan Service

Pin On Certificate Template Ideas

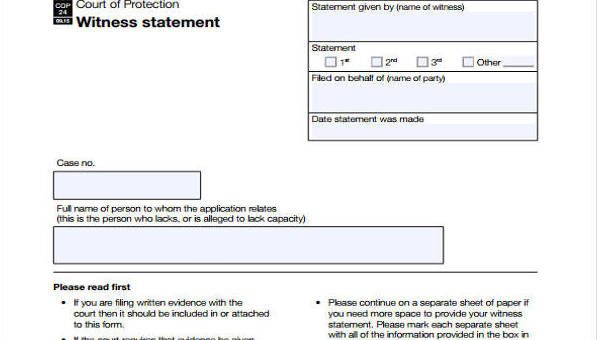

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

38 Project Report Templates Word Pdf Google Docs Free Premium Templates

Download Letter Of Recommendation 03 Reference Letter Reference Letter Template Letter Of Recommendation

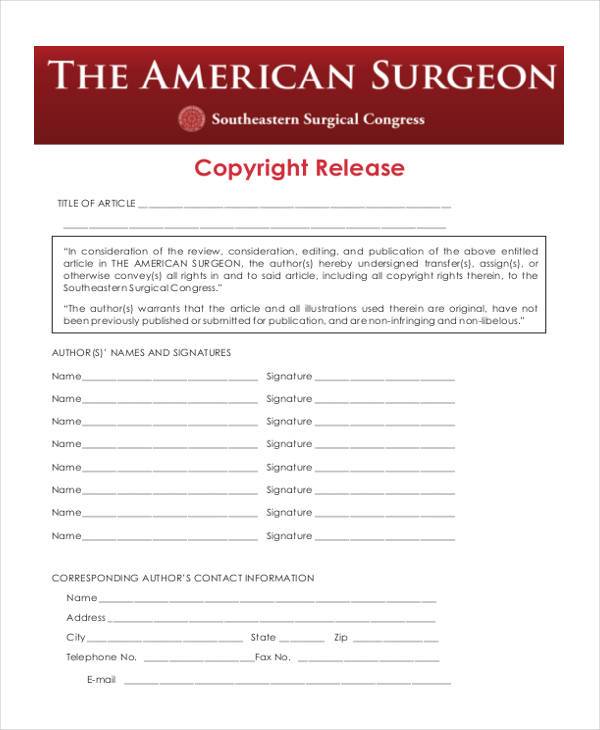

Free 38 Release Forms In Pdf Excel Ms Word

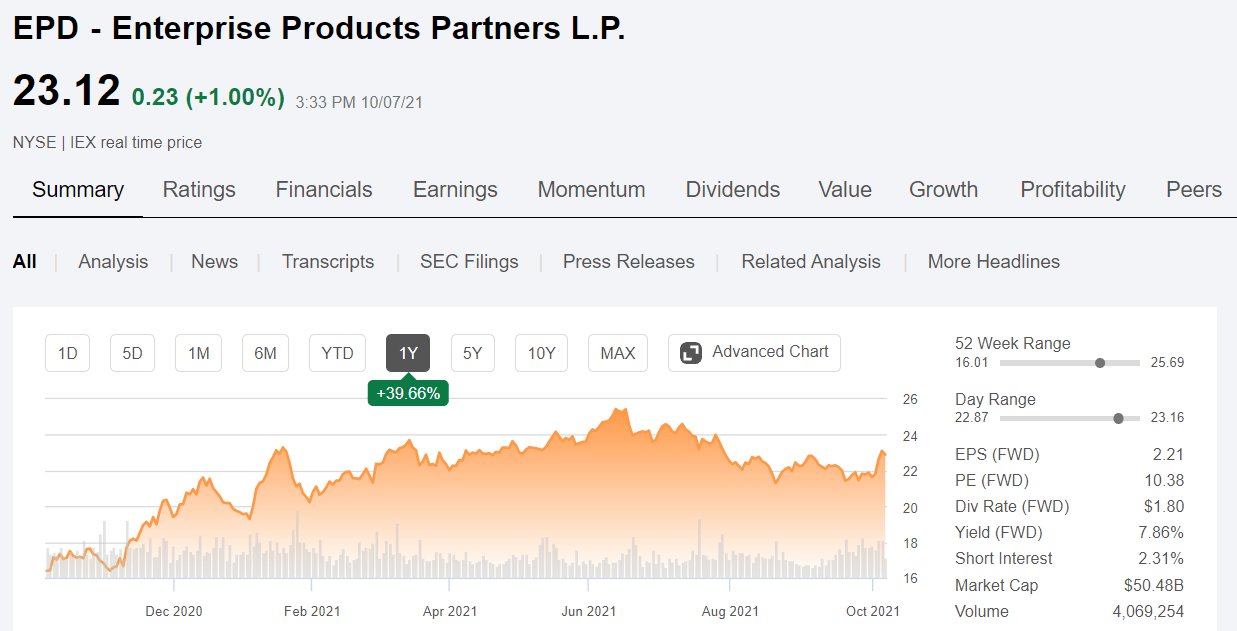

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha

Tim Mcbratney Cma Pacres Mortgage

Business Proposal Letter Writing Proposal Letter Business Proposal Letter Business Proposal Sample

Tim Mcbratney Cma Pacres Mortgage

38 Project Report Templates Word Pdf Google Docs Free Premium Templates

32 Sample Business Proposal Letters Business Proposal Letter Proposal Letter Business Proposal

38 Sample Closing Statement Templates In Pdf Ms Word